If you’ve been dreaming of a seaside home in Albania, chances are Saranda has made your shortlist. Known for its crystal-clear waters and ever-growing expat community, this southern gem has become one of the country’s hottest property markets and 2025 proves it.

According to our latest data gathered by led by Eliseo Kolicaj, our data analyst, 1-bedroom apartments in the city centre jumped by 64.3% in price over the past year, one of the most dramatic surges across Albania. With the growing demand, especially from foreign buyers, the gap between “affordable” and “premium” is shrinking fast.

So… is Saranda still a smart investment? Let’s look at the data.

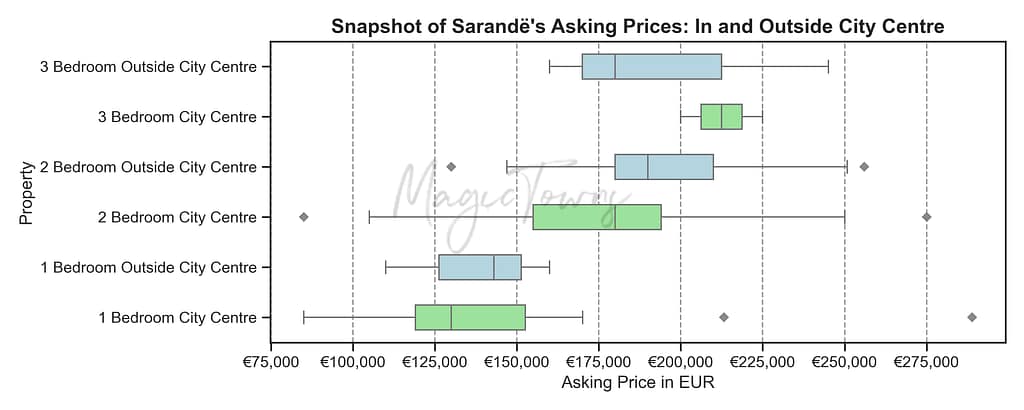

Rising Prices for Saranda Flats

Right now, the average price per square meter in the city centre sits at €1,924/m², putting Saranda almost on par with Tirana’s city centre (€2,125/m²) and higher than Durrës. Outside the city centre is €1,886/m². That’s almost the same as the central price, showing how compressed the pricing structure has become due to surging interest and limited inventory. From compact city flats to sprawling seaside homes, the mix of buyer behaviour, location desirability, and speculative pricing creates clear signals, if you know where to look.

1-Bedroom Apartments

1-bedroom units are the clear growth leaders. In the city centre, prices rose from €1,171 to €1,924/m²—a 64.3% increase. Outside the centre, they climbed from €1,258 to €1,886/m² (+49.8%). These units have the tightest price spreads on the chart, especially outside the centre, signalling high demand and relatively consistent pricing. Even the outliers remain modest, suggesting this is a deep, liquid market with little room for fantasy pricing. One-beds are the go-to for expats, first-time buyers, and short-let investors. The near price parity between centre and periphery reflects the fact that “outside” often means better views and newer builds, not reduced value.

2-Bedroom Apartments

These are showing early signs of instability. In the city centre, prices nudged up from €1,622 to €1,812/m² (+11.7%), but outside the centre, they dropped from €1,733 to €1,682/m² (−2.9%). The decline outside the centre—combined with the widest interquartile range and a cluster of extreme outliers—suggests a market unsure of its value. Some sellers are clearly testing the upper end (€275k+), but median values remain closer to €175k–€190k. Buyers may be moving away from generic 2-bed layouts in favour of either more affordable 1-beds or lifestyle-driven 3-bed sea-view homes. Middle-of-the-road is looking less attractive in 2025.

3-Bedroom Apartments

3-bedroom homes represent the upper end of Saranda’s market and the most uneven. Outside the centre, prices are by far the highest overall, with a median comfortably above €200,000 and a wide spread that stretches well past €250,000. The most extreme outliers likely reflect luxury developments: penthouses, sea-facing terraces, or properties with private pools. Inside the city, price growth has been faster in €/m² terms, possibly due to tighter supply and growing appeal among long-stay buyers and families who want walkability without sacrificing space. These large units are no longer the domain of local families alone. They’re increasingly attractive to semi-retired couples, remote professionals, and multi-generational households. But this is also where the most speculative pricing lives, and distinguishing genuine value from hype requires a sharp eye.

Final Thoughts for Buyers:

1-beds are the surest bet—strong growth, tight pricing, and broad appeal. 2-beds outside town are entering a correction phase, dragged down by oversupply or waning interest. 3-beds reflect a bifurcated market: solid demand in the centre, and a luxury-led pricing boom in the hills and along the coast. Outliers tell the story—most segments contain sellers pricing far above market norms. That’s a risk and an opportunity, depending on your negotiation skills.

Conclusion: Saranda’s market is transitioning from frontier to finesse. There’s value to be found but you’ll need local insight, sea-view awareness, and a sharp eye for pricing distortion.

Subscribe to our newsletter to get regular updates on this topic.

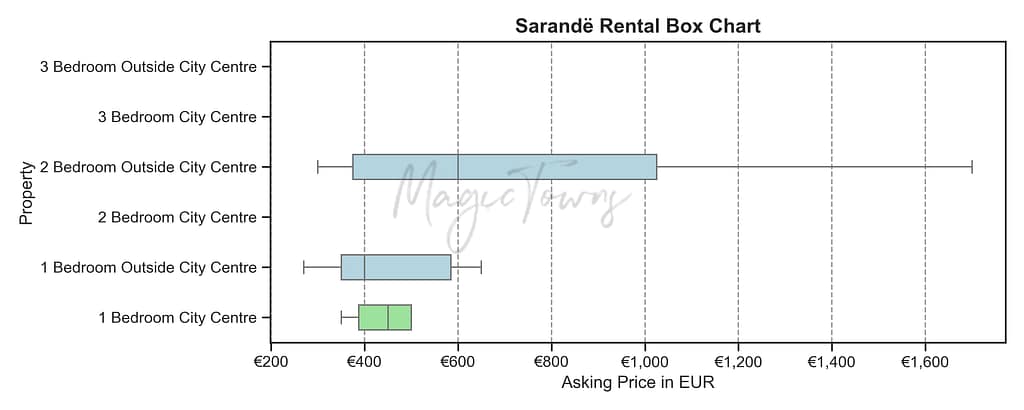

How About Rent?

Rental prices in Saranda offer a more scattered picture than sales prices, in part due to inconsistent data quality. For this reason, we’ve chosen to exclude 3-bedroom rentals from the chart. There simply weren’t enough reliable listings to produce a representative sample. Many were short-term or seasonal lets rather than long-term contracts, or featured speculative pricing that distorted the averages. As the long-term rental market matures, we’ll update this with more consistent data.

1-Bedroom Apartments: Stable and Predictable

One-bedroom rental prices are relatively consistent across both city centre and outlying areas. In the city centre, median rents sit just below €450 per month, with a narrow spread suggesting a healthy, transparent market. Outside the centre, prices edge slightly higher on average—likely due to newer builds or better views—but still fall within a fairly contained range, generally between €400 and €650. The limited variability here implies a well-functioning market with demand from expats, solo tenants, and seasonal residents being met by supply that knows its price point.

2-Bedroom Apartments: Wildly Divergent

Two-bedroom flats tell a more chaotic story. In the city centre, rental prices tend to cluster between €400 and €600 per month, with little evidence of major outliers. Outside the centre, however, the spread is enormous—ranging from €400 all the way up to €1,600+. This suggests a deeply fragmented market, possibly reflecting a mix of long-term rentals, luxury short-lets, and over-ambitious listings. The size of the interquartile range here is the largest on the chart, indicating that renters should approach two-bed listings outside the city with caution and a keen eye for value. This segment is currently the least transparent and the hardest to price confidently.

Pensieri finali for Renters

Renting in Saranda is generally affordable, particularly for one-bedroom units, which remain the most stable and investor-friendly category. The two-bedroom segment—especially outside the centre—shows considerable volatility, hinting at inconsistent quality and market segmentation. As for three-beds, the lack of reliable rental data reflects a market still finding its shape. For now, investors and tenants alike should tread carefully outside the core one-bedroom segment and seek local insight when navigating price versus value.

Rental Yields: Not High, But Still Respectable

| Property Type | Area | Median Price | Median Rent | Gross Yield |

|---|---|---|---|---|

| 1 camera da letto | City Centre | €135,000 | €450 | ~4.0% |

| 1 camera da letto | Outside Centre | €145,000 | €500 | ~4.1% |

| 2-Bedroom | City Centre | €175,000 | €550 | ~3.8% |

| 2-Bedroom | Outside Centre | €195,000 | €650–1,000 | 3.5–5.5% |

| 3-Bedroom | Either | €200,000+ | ? | Unknown |

Gross yield = (Annual Rent ÷ Purchase Price) × 100

These are unadjusted yields—i.e. before taxes, fees, voids, or maintenance—and based on the median values observed in our research

Final Thoughts for Investors

- 1-bed apartment remain the most reliable buy-to-let option, offering stable gross yields just over 4% in both centre and fringe.

- 2-bed apartments could outperform, but only if you secure a property with strong rental appeal. They carry more variability and risk.

- 3-bed apartments should not be purchased purely for rental income until the long-term market becomes clearer. At present, they are best treated as lifestyle or hybrid use investments.

It is important to remember that we are calculating yields on long term rental contracts, however its worth bearing in mind that many investor are receiving far higher yields by short term tourist rentals (which is something a Lot of locals are doing, especially with the increased number of tourists in Albania in the recent years).

Saranda Rewards the Well-Informed

One-bedroom apartments remain the most dependable buy-to-let option, offering consistent returns and minimal fuss. Two-beds offer more upside, if you choose well. But they also come with more risk, especially outside the centre where pricing and quality vary wildly. Three-beds, for now, are best treated as lifestyle buys or short-let investments, not long-term rentals.

While this analysis focuses on long-term rental contracts, it’s worth noting that many investors, especially locals, are achieving significantly higher returns through short-term tourist lets. With record tourism numbers in recent years, summer rentals have become a reliable income stream for those who can manage them well.

If you’re looking at Albania in 2025, Saranda stands out as a market in transition. It’s no longer undiscovered. Buyers are arriving sooner, inventory is tightening, and the smartest investments now depend on micro-level knowledge.

Yields don’t come from size or location alone—they come from knowing the street, the building, the view, the season. Saranda still offers real opportunity but not for passive or speculative buyers. It rewards the informed, the selective, and those who have done there homework.